Overlanding

Overlanding Adventure Derailed: What if All Your Gear is Stolen or Wrecked in a Crash?

By Scott O’Sullivan, Founder of Rider Justice & Overlanding Enthusiast

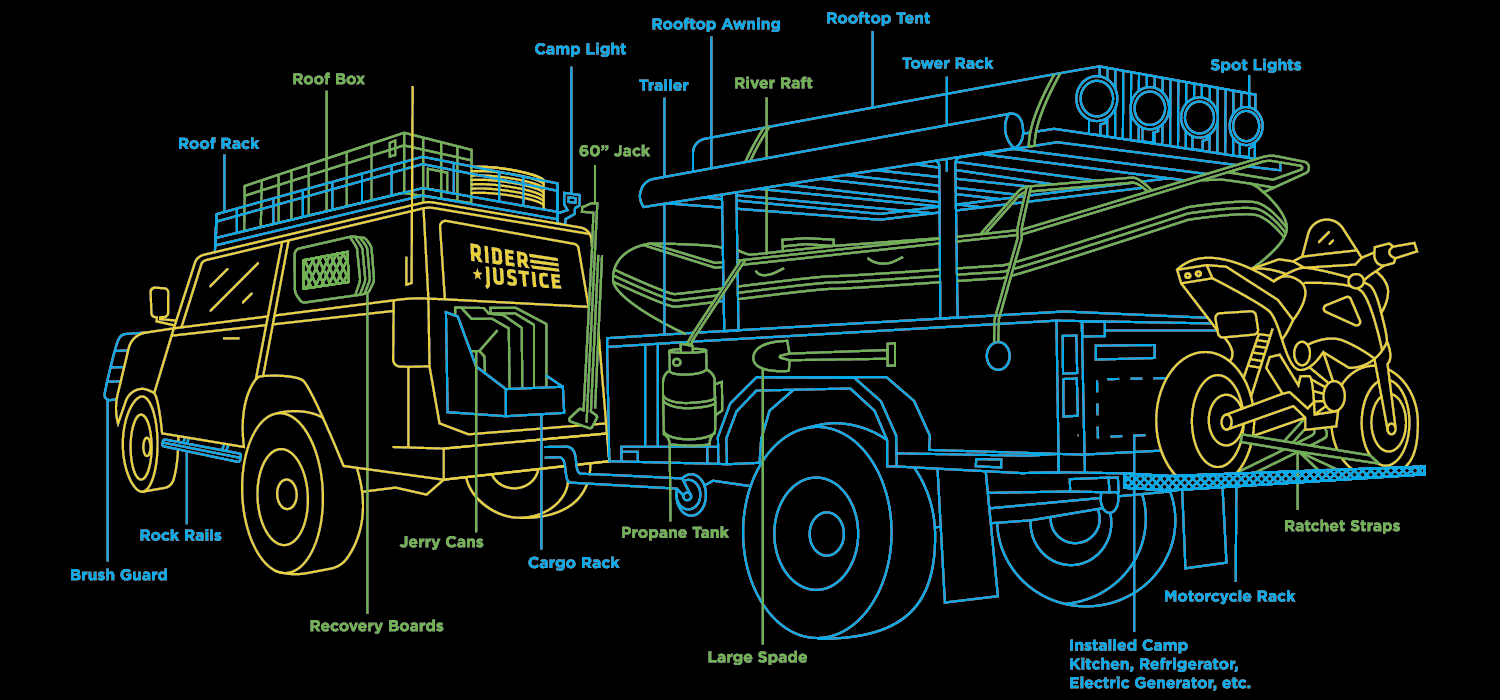

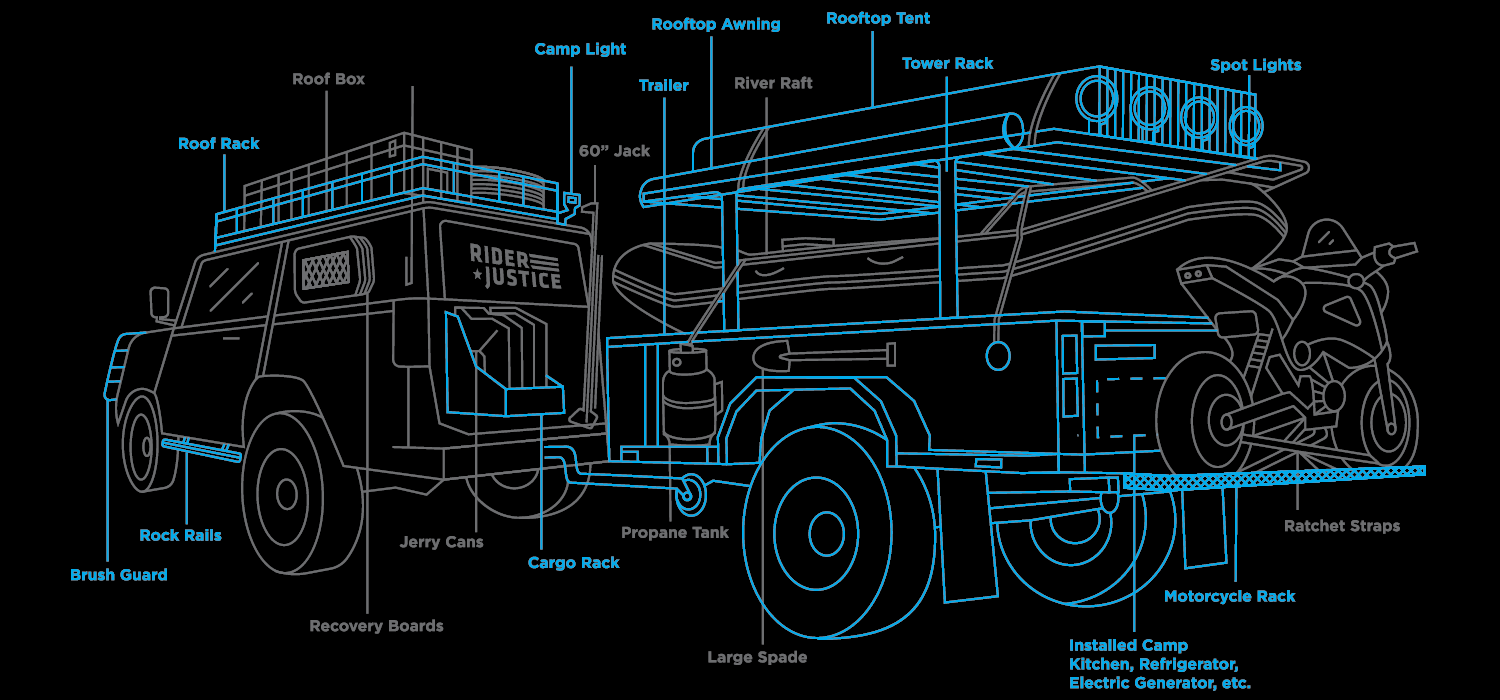

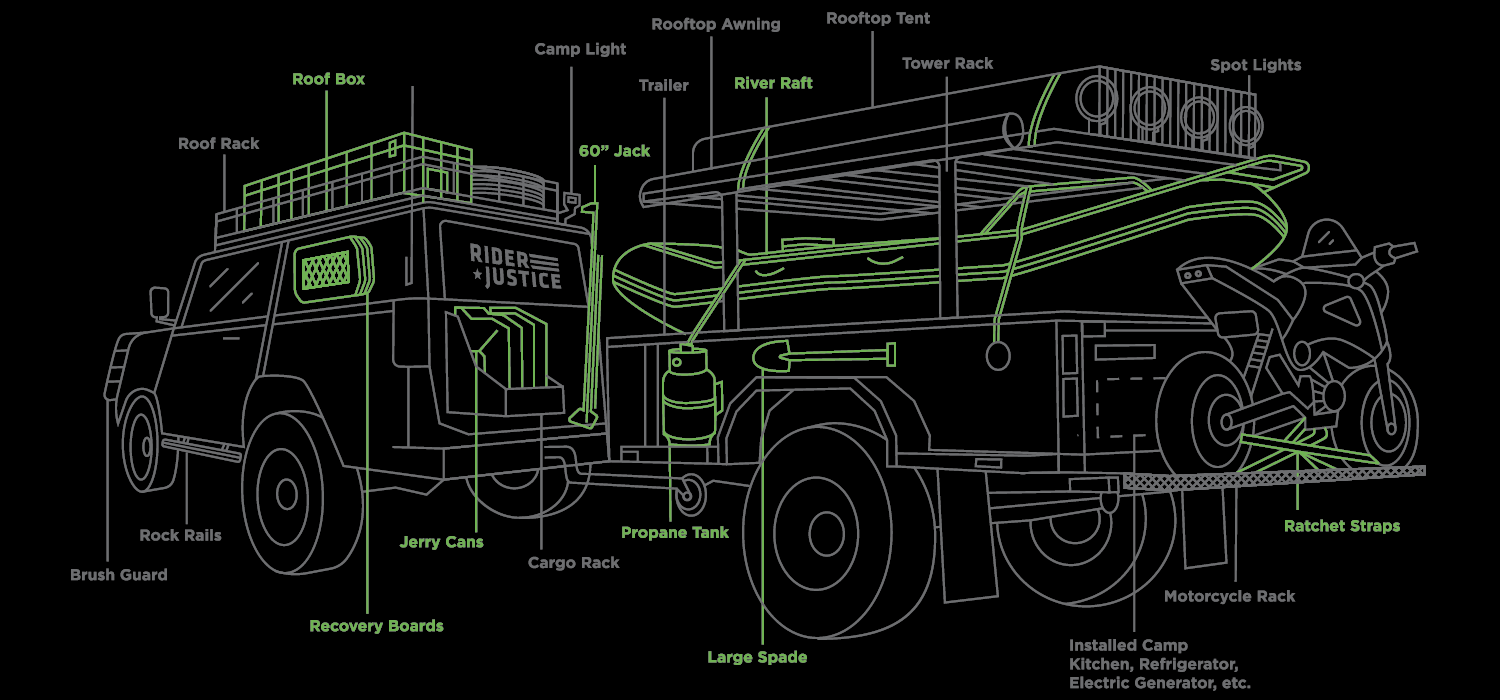

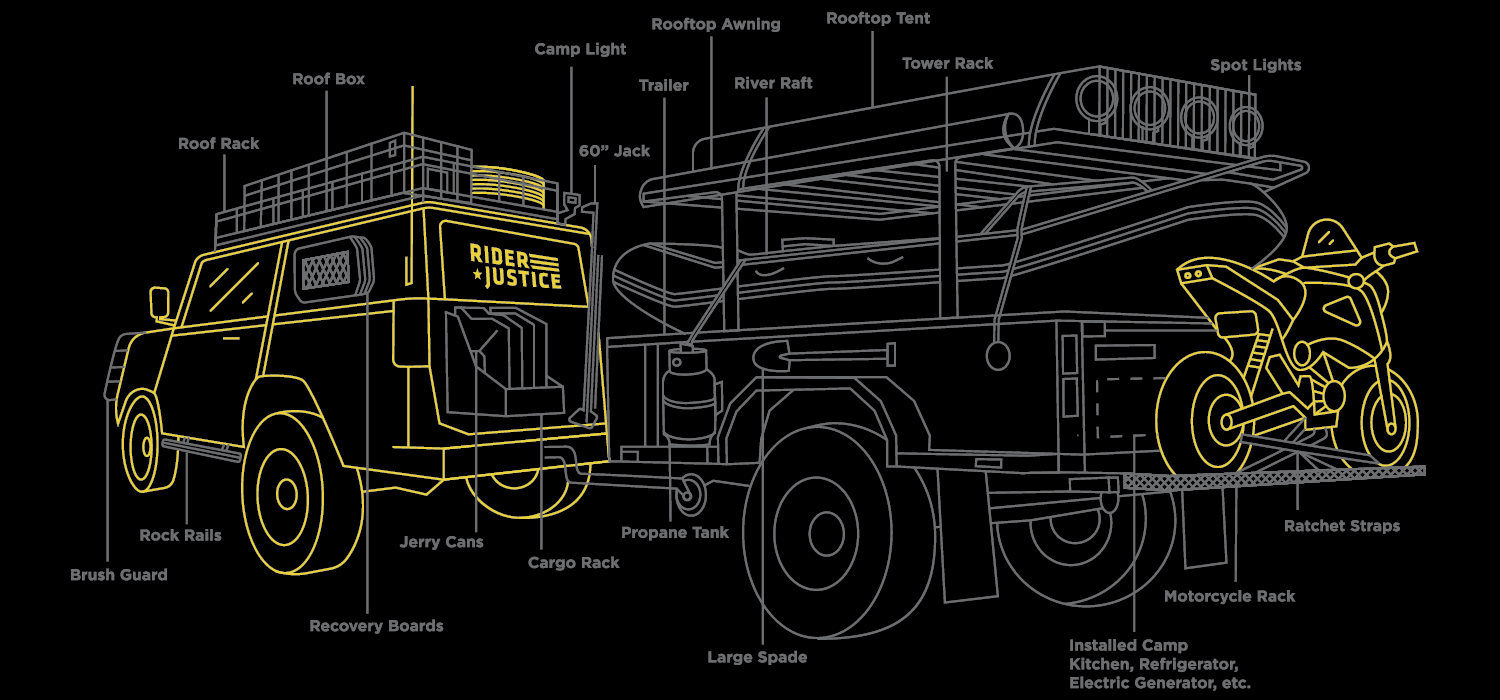

You’ve outfitted your rig for overlanding. You lifted the vehicle. You added new bumpers, new wheels and tires. You added a fridge and power supply. A roof-top tent. You’ve got the bike rack. The bikes. The kayak rack. The kayak. The fly-fishing rack. The poles. The camper. The coolers. The tents and sleeping bags and air mattresses, cookware, camp chairs, cameras…

Holy moly you’ve invested in your ability to get outdoors! Your vehicle, whether it’s a Jeep, a Toyota 4-Runner, or another vehicle entirely, is now like a Swiss Army Knife for camping and getting away from it all. Good for you!

But have you thought about what would happen if that gear were stolen? Or if you were in an accident?

Before you leave on your next overlanding adventure, you need to insure all of that equipment. It’s not as expensive as you might imagine and, given how much you’ve invested, it is totally worth the pennies-on-the-dollar that you will spend to guarantee that you can replace it.

What Kind of Insurance Covers My Camping and Adventure Gear?

I had to do a lot of research to figure out exactly how to insure the gear that I put into and onto my Rider Justice truck. Believe me, I was shocked to discover how much I had invested and that it wasn’t covered by insurance! So, I was personally very motivated to get these details right.

In a nutshell: You need different insurance for the items you affix permanently on your vehicle and the items you load into your vehicle. I will address them separately.

Serving the Overlanding Community in these States

Colorado

Georgia

Tennessee

Oregon

Virginia

South Carolina

How to Insure the Items You Affix Permanently to Your Vehicle

Click image to enlarge and zoom

Take a mental inventory of all the items you have affixed to your vehicle for overlanding: tires, wheels, lift, bumpers, lights, auxiliary power, roof top tent, hitch, roof rack, fly-fishing rack, kayak rack, bike rack. Now, imagine a deer jumps out into the road… I have seen cars and campers demolished from such a collision. If you don’t have all that gear insured, you could lose it all.

Make sure you have enough comprehensive and collision insurance. What is the difference? Here is an easy way to understand them:

- Comprehensive: “It hits you.” (Such as a deer, a falling tree, etc.)

- Collision: “You hit it.” (Such as a standing tree, light pole, giant rocks while you’re off-roading, etc.)

(If someone else hits you in a car crash, their insurance should cover damages. But if they aren’t insured well, you need to make sure you have UIM coverage. See the bottom of this article for more on UIM.)

I recommend that you collect receipts and take photos of everything you mounted on your vehicle. Then, call your insurance agent to purchase enough insurance to cover all of those permanent changes you added.

How to Insure the Items You Load Into Your Vehicle for Camping and Adventure Trips

Click image to enlarge and zoom

OK, you’ve got the racks and hitches covered. Now, what about the coolers and tents and cookware and drones and all that amazing gear you’ve purchased over the years?

That stuff is actually covered by your homeowner’s or renter’s insurance under a section called “content coverage.” This is the same section of your insurance that covers your TV, bike, clothes, photos and more, but the coverage changes as soon as you walk it outside your home.

Basically, if you haul it out of your house and put it in your car to go camping, your coverage plummets to 10% of your policy limits.

This gets tricky so stay with me…

If that stuff were stolen out of your home, you would get full coverage for it under your homeowner’s or renter’s insurance, depending on your policy limits. But the minute you walk it out the door and put it in your vehicle, your coverage drops to 10%.

So, your bike? If it’s worth $3,000 and it is stolen from your car or destroyed in a crash, you may only get $300 for it, depending on your policy limits.

I recommend that you, again, take a mental inventory of all the stuff you take camping, overlanding and adventuring. Collect receipts and take photos.

Then, call your agent and increase your coverage to the point that you would get 100% of the value of those items. For example, if you put $7,000 worth of gear into your vehicle (which is shockingly easy to do), you will need over $70,000 of content coverage on your homeowner’s or renter’s insurance. And that’s just to cover your camping gear; don’t forget all the other stuff in your home that you don’t take camping.

But the good news is that this insurance coverage will likely only cost you a few more dollars a year. Totally worth it!

Call your insurance agent before your next outing.

Underinsured Motorist Coverage (UIM)

Now, it’s time for my regular UIM mantra. If you haven’t heard this before, and if you don’t have UIM insurance, please pay attention!

First of all, if someone else hits you, they probably won’t have enough insurance to cover all of your adventure gear, other vehicle damage and medical care. It’s just that simple.

Even if you have great auto insurance and healthcare insurance, you need UIM on every auto policy you buy because UIM covers a lot more than you might expect.

UIM policies cover the following:

- Lost wages

- Current and future medical expenses

- Any damage arising from the accident (with the exception of property damage, which should be covered by the rest of your policy)

- All economic and noneconomic loss, which includes pain and suffering

Too often, victims expect the bad guys to “make things right.” If the bad guy is insured well and doesn’t flee the scene, then you are one of the lucky ones. Normally, the bad guy is underinsured. You need UIM.

Adventure On! Call Your Insurance Agent Today

I hope this article has convinced you to call your insurance agent and start a conversation about covering your adventure gear. If you need any guidance on the types of insurance you need, I would happily chat with you. (I love a good overlanding adventure gear conversation!)